What’s the value of a tooth? In the 1950s, when I was losing my first tooth, the going rate for the tooth fairy was 25 cents. My wife confirms she had the same experience, even though she grew up in Florida, while I grew up in Pennsylvania. Alas, inflation seems to have impacted everyone, including the tooth fairy. Serena Ng, writing for The Wall Street Journal, tells us what the tooth fairy is paying today.

“When her daughter was about to lose her first baby tooth, Kokoa Lawson went to work researching ideas. She wanted to make the tooth fairy experience magical and extra special for her only child. She gave her daughter a $100 bill decorated with glitter and tiny removable rhinestones. “She kind of lost her mind when she found it,” says Lawson, who lives in Temecula, Calif.”

But some cousins were jealous about the tooth-fairy haul and Lawson says she “did get a little pushback from friends.” “I simply said, ‘This is just what our tooth fairy does,’ and suggested they make it special in their own way for their kiddos,” says Lawson, 40, who works as a model and actress. Her outlay dropped to $20 for subsequent teeth.

The tooth fairy is getting more generous and creative worldwide—and parents are learning how tricky that can be. Parents already were going big for birthday parties and college acceptances, but now they are increasingly making a splash for smaller milestones, too. Pinterest, the online platform for sharing ideas, calls the phenomenon “inchstones” and has declared it a top predicted trend for 2024.

Global Pinterest searches were up for “potty-training rewards ideas” (100%), “end-of-year school party ideas” (90%), and “my first tooth party” (40%) between September 2021 and August 2023.

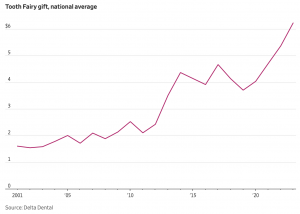

A poll last year by Delta Dental, a large U.S. provider of benefits, pegged the average payout per lost tooth at a record $6.23, from $5.36 in 2022. It isn’t just inflation delivering a bite. The same poll found 20% of children now receive both money and something else—often a gift—for each lost tooth.

“Cash, a videogame, sometimes an iPhone,” says Mark Burhenne, a former practicing dentist who runs AsktheDentist.com. “It’s the parents competing” to improve the gifts, adds Burhenne, 64, who lives in Napa Valley, Calif. (His 35-year-old daughter Catharine Burhenne, who co-founded the website, says she is bucking the “generous gifting” tooth-fairy trend. She recently enlisted ChatGPT late one night to write a note from the tooth fairy.)

In the U.K. Chidera Nig, 32, says the tooth fairy gave her daughter 60 British pounds, equivalent to $76.50, a letter and a silver fairy necklace, along with a Louis Vuitton bracelet. Nig says her husband purchased the bracelet on the day their daughter was born, and it felt like the right time to give it to her. “That was her first baby tooth that she lost, and the process was uncomfortable for her, so we decided to give her the extra tooth fairy experience,” says Nig, a content creator. The money went into a piggy bank. “Childhood goes by so fast and we believe in cherishing every moment, celebrating milestones and creating long-lasting memories.”

Anuradha Singh, 51, a lawyer, asked her husband to take over her tooth fairy duties while she was traveling from their home, then in Hong Kong. Lacking change and not knowing the going rate for baby teeth, he left the equivalent of $64 under their child’s pillow, Singh says, adding: “It was an utter failure by the deputy tooth fairy.” She says she tried to claw the money back, but her daughter, then seven, resisted.

One problem—kids talk and compare.

In Cheshire, England, before five-year-old Rae lost her first tooth last autumn, she wrote to the tooth fairy, requesting a gift for herself, and something for her little sister. On the big night, she received three British pound coins, and two chocolate coins to share with her sister. On the way to school the next morning, Rae ecstatically told everyone she met what the tooth fairy had brought.

“I didn’t think about how that would unfold,” says Natasha Evans, Rae’s mother. “The others were like, hang on—the tooth fairy didn’t bring us chocolate coins!” Some children said they received only one pound, and one said they got a five-pound note. The other parents looked uncomfortable. Evans, who is 35 and manages a post-sales team at a software company, had to explain to each child and parent how the tooth fairy delivered chocolate because Rae had asked for something for her sister. “I said the tooth fairy normally doesn’t do that, and the next time she won’t do that,” says Evans, adding that she plans to stick to just money going forward.

To put this all in perspective, I did a little research. One dollar in 1950 is worth $13 today. That means the 25 cents I received from the toothy fairy in the 50s is worth $3.25 today. Inflation is affecting everyone, but it seems the tooth fairy has gone way beyond the real inflation rate. I’ve said it before and I’ll say it again – some people just have too much money and too much time on their hands!