It’s bad enough that the Biden/Harris Administration is expanding the rolls of Medicaid and therefore increasing the taxpayer’s burden. But now add to that scandal what’s happening to Medicare when that friendly nurse comes to visit your home.

In a new article published in The Wall Street Journal, the authors reveal how private insurance companies are bilking the government for billions. Anna Wilde Mathews, Christopher Weaver, Tom McGinty, and Mark Maremont now reveal the results of an intensive investigation into the home nursing business. Here’s how they describe what is happening:

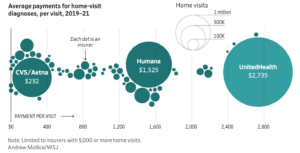

“Millions of times each year, insurers send nurses into the homes of Medicare recipients to look them over, run tests and ask dozens of questions. The nurses aren’t there to treat anyone. They are gathering new diagnoses that entitle private Medicare Advantage insurers to collect extra money from the federal government. A Wall Street Journal investigation of insurer home visits found the companies pushed nurses to run screening tests and add unusual diagnoses, turning the roughly hourlong stops in patients’ homes into an extra $1,818 per visit, on average, from 2019 to 2021. Those payments added up to about $15 billion during that period, according to a Journal analysis of Medicare data.”

Nurse practitioner Shelley Manke, who used to work for the HouseCalls unit of United Health Group was part of that small army making home visits. She made a half-dozen or so visits a day, she said in a recent interview. Part of her routine, she said, was to warm up the big toes of her patients and use a portable testing device to measure how well blood was flowing to their extremities. The insurers were checking for cases of peripheral artery disease, a narrowing of blood vessels. Each new case entitled them to collect an extra $2,500 or so a year at that time.

But Manke didn’t trust the device. She had tried it on herself and had gotten an array of results. When she and other nurses raised concerns with managers, she said, they were told the company believed that data supported the tests and that they needed to keep using the device.

Last month WSJ reported that insurers received nearly $50 billion in payments from 2019 to 2021 due to diagnoses they added themselves for conditions that no doctor or hospital treated. Many of the insurer-driven diagnoses were outright wrong or highly questionable, the Journal found. The diagnoses added after home visits accounted for about 30% of that total. More than 700,000 peripheral artery disease cases diagnosed only during home visits added $1.8 billion in payments during that period.

How could this be happening?

That’s a good question and one that should be asked by those in the federal government in charge of Medicare – the Center for Medicare and Medicaid Services (CMS). This abuse of the system is happening particularly in the Medicare Advantage system. In the Medicare Advantage system—conceived as a lower-cost alternative to traditional Medicare—private insurers get paid a lump sum to provide health benefits to about half of the 67 million seniors and disabled people in the federal program. The payments go up when people have certain diseases, giving insurers an incentive to diagnose those conditions. But the system should not be paying for diagnoses not made by the treating physician. Allowing home nurses to add diagnoses is simply letting the fox into the chicken coop.

(Note: For more on this subject, stay tuned for my next post – Part II of this series.)