In Part I of this series, we learned that home nursing visits are being used by private insurers to bilk the taxpayers for billions in additional Medicare funding. In Part II we will see who is abusing the system the most and how they do it.

The Wall Street Journal reported on an investigation into the home nursing industry and found home nurses were adding billions to the cost of Medicare. To find out how insurers use home visits to add diagnoses, the Journal interviewed nurses, patients, home-visit managers and industry executives and reviewed hundreds of pages of internal documents from home-visit companies. They described a system that used nurses, software and audits to generate diagnoses.

“They do the job with a purpose, and it pays off for the Medicare Advantage plans,” said Francois de Brantes, a former executive at Signify Health, a company that does home visits for insurers. “Identifying the diagnoses, that’s the job.” Insurers, including UnitedHealth and CVS Health, owner of both Signify and Aetna, said the house calls help patients by, among other things, catching diseases early and making sure people are taking their medicine properly. The insurers said they relay home-visit findings to primary-care doctors.

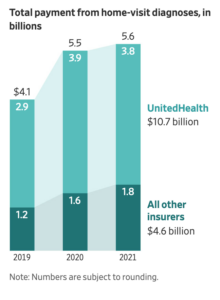

Nurses who made visits said they felt they were helping some patients with advice about medications, performing needed tests and sometimes reporting health emergencies. For UnitedHealth, the parent company of the largest Medicare insurer, each home visit was worth about $2,735 in extra Medicare payments during the three years covered by the data, the Journal analysis found. That’s nearly three times the average for all other Medicare Advantage insurers.

UnitedHealth’s chief physician, Dr. Wyatt Decker, attributed the disparity to what he said was UnitedHealth’s sicker patient population and its nurse practitioners being so effective at their jobs. (No surprise there!) Sixty percent of UnitedHealth home visits generated at least one new revenue-producing diagnosis of a condition no doctor was treating, the analysis showed. Home visits by Humana, the No. 2 Medicare insurer, did so 39% of the time.

Step one is getting Medicare Advantage recipients to agree to a visit, especially patients whom insurers deem most likely to have undiagnosed conditions that would garner extra payments. Two former managers who oversaw home visits for Humana, and a third who worked for both Humana and Signify, said insurers used an internal scoring system to identify prospects. Under the Medicare Advantage system, diagnoses have to be documented every year to trigger the extra payments, so people who had an earlier home visit that produced extra payments were particularly valued, the managers said. Insurers also considered other factors, including how likely patients were to agree to a visit, some home-visit executives said.

The Medicare Payment Advisory Commission, a nonpartisan agency that advises Congress, has recommended that diagnoses from home visits shouldn’t count toward extra payments to Medicare insurers. The inspector general that oversees the Medicare agency has said it should reconsider the use of such diagnoses. A spokeswoman for the Centers for Medicare and Medicaid Services, said the agency recently ramped up audits to verify diagnoses. The agency also is eliminating some diagnoses from those that qualify for extra payments, including peripheral artery disease.

This is the kind of investigative journalism we need more of and my hat’s off to the Journal for this in-depth look at the home nursing industry. We cannot afford this kind of wasteful spending if our Medicare system is to survive.